Insurance + Financial Assistance

No one will be denied access to medically necessary services due to inability to pay and there is a discounted / sliding fee schedule available based on family size and income.

A nadie se le negarà el acceso a los servicios medicos y necesarios debido a la imposibilidad de pagar, tambien hay un programa de tarifas con descuento / variables depende el tamaño de la familia y los ingresos.

Thank you for choosing Myrtue Medical Center for your health care needs. We are committed to providing the highest quality care throughout your entire patient experience, and we take a proactive, customer-oriented approach to patient billing and collections.

We will verify your personal and insurance information with you each time you visit. At the time of registration, we ask that you pay for any co-pays or deductibles designated by your insurance plan. If your insurance plan requires notification or pre-authorization prior to obtaining services, please provide documentation verifying this has been done.

No Surprises Act

Effective January 1, 2022, the No Surprises Act, which Congress passed as part of the Consolidated Appropriations Act of 2021, is designed to protect patients from surprise bills for emergency services at out-of-network facilities or for out-of-network providers at in-network facilities, holding them liable only for in-network cost-sharing amounts. The No Surprises Act also enables uninsured patients to receive a good faith estimate of the cost of care.

If you have any questions about insurance, self-pay, or financial assistance, our Patient Financial Advocates are here to help at 712.340.1270.

Financial Assistance

Financial assistance is available to eligible individuals and families based on financial need. Emergency services will never be delayed or withheld on the basis of a patient’s ability to pay. You may qualify for financial assistance if you:

- Have limited or no health insurance

- Are not eligible for government assistance

- Can show you have a financial need

- Reside within MMC’s primary service area

- Provide MMC with household financial information

- Have medical bills that exceed your ability to pay as determined by MMC guidelines

Click the following links to download additional information:

- Financial Assistance Application

- Financial Assistance and Collection Policy

- Financial Assistance and Collection Policy - Plain Language Summary

Medicare Open Enrollment Period

The Medicare Open Enrollment Period, which occurs each year from October 15th to December 7th, gives people eligible for Medicare the chance to review and make changes to their current Medicare coverage. The following links include information to help you prepare for Medicare Open Enrollment and get the most out of your Medicare coverage:

- Original Medicare vs. Medicare Advantage

-

Contact Your Senior Health Insurance Information Program (SHIIP)

- The Harlan State Health Insurance Assistance Program (SHIIP) office is located at 706 Victoria Street inside the Therkildsen Center, 712.755.2757.

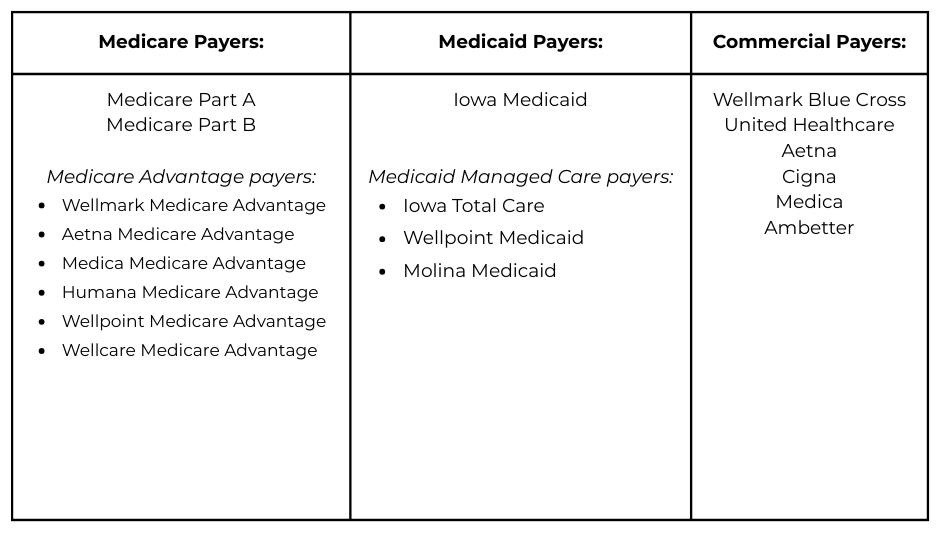

Myrtue is contracted with the following insurance companies / networks:

Billing Disclosures – Your Rights and Protections Against Surprise Medical Bills

When you get emergency care or get treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing.

What Is “Balance Billing” (Sometimes Called “Surprise Billing”)?

When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a co-payment, co-insurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” describes providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care – like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

You Are Protected From Balance Billing For:

Emergency services

If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as co-payments, deductibles, and/or co-insurance). You cannot be balance billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center

When you get services from an in-network hospital or ambulatory surgical center, certain providers may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers cannot balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other services at these in-network facilities, out-of-network providers cannot balance bill you, unless you give written consent and give up your protections.

You are never required to give up your protections from balance billing. You also are not required to get care out-of-network. You can choose a provider or facility in your plan’s network.

Additionally, the Iowa law applies to patients covered under state-regulated insurance plans and insurance plans subject to the jurisdiction of the superintendent of insurance.

When Balance Billing Isn’t Allowed, You Also Have the Following Protections:

You are only responsible for paying your share of the cost (like the co-payments, co-insurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

Your health plan generally must:

- Cover emergency services without requiring you to get approval for services in advance (prior authorization).

- Cover emergency services by out-of-network providers.

- Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

- Count any amount you pay for emergency services or out-of-network services toward your deductible and out-of-pocket limit.

If you believe you’ve been wrongly billed, you may contact:

- Call 1.800.985.3059 to submit a complaint regarding potential violations of the No Surprise Act

- Visit cms.gov/nosurprises for more information about your rights under federal law

Good Faith Estimate

You have the right to receive a “Good Faith Estimate” explaining how much your medical care will cost.

Under the law, healthcare providers need to give patients who don’t have insurance or who are not using insurance an estimate of the bill for medical items and services.

- You have the right to receive a Good Faith Estimate for the total expected cost of any non-emergency items or services. This includes related costs like medical tests, prescription drugs, equipment and hospital fees.

- Make sure your healthcare provider gives you a Good Faith Estimate in writing at least one business day before your medical service or item. You can also ask your healthcare provider, and any other provider you choose, for a Good Faith Estimate before you schedule an item or service.

- If you receive a bill that is at least $400 more than your Good Faith Estimate, you can dispute the bill.

- Make sure to save a copy or picture of your Good Faith Estimate.

Get More Information

For questions or more information about your right to a Good Faith Estimate, visit

cms.gov/nosurprises or call

712.340.1270.